Regarding funding your house, one to dimensions cannot match most of the. And while traditional options eg money, home guarantee lines of credit (HELOCS), refinancing, and reverse mortgages can perhaps work better for most homeowners, the new current rise out of financing possibilities eg family security investors and almost every other growing networks have made it obvious there is an ever-increasing demand for other available choices. Discover more about choice how to get equity from your family, to generate a more advised decision.

Antique Solutions: Advantages and disadvantages

Fund, HELOCs, refinancing, and contrary mortgage loans can all be glamorous ways to tap into this new equity you gathered in your home. Although not, you’ll find commonly as much drawbacks and there is gurus – so it’s important to see the benefits and drawbacks of every to learn as to why particular home owners need money alternatives. Understand the chart less than so you can easily examine mortgage selection, after that continue reading for more information on for every.

Family Security Loans

A property security mortgage the most popular ways one homeowners accessibility its guarantee. You can use benefits, also a foreseeable payment per month due to the loan’s repaired focus rate, in addition to undeniable fact that you’re getting the fresh new collateral in one swelling share commission. Thus, a property equity financing usually is practical if you’re looking to coverage the price of a restoration venture or large one to-away from debts. Including, your appeal payments is income tax-allowable while you are using the currency to possess renovations.

Why try to find a home collateral financing solution? A number of explanations: Basic, you’ll want to pay the mortgage and additionally the typical mortgage payments. And if your own borrowing is actually shorter-than-expert (not as much as 680), you do not also be accepted having a property equity mortgage. Finally, the application form techniques is going to be intrusive, complicated, and you can taxing.

Domestic Guarantee Personal lines of credit (HELOC)

HELOCs, a common replacement property guarantee financing, bring easy and quick access to finance should you decide you would like her or him. And even though you generally speaking you want at least credit rating out of 680 in order to qualify for a good HELOC, it can actually help you alter your rating over time. In addition, you are capable enjoy income tax professionals – deductions around $100,100000. Once the its a personal line of credit, there is absolutely no focus owed if you don’t pull out money, and you will remove as much as need until your struck the maximum.

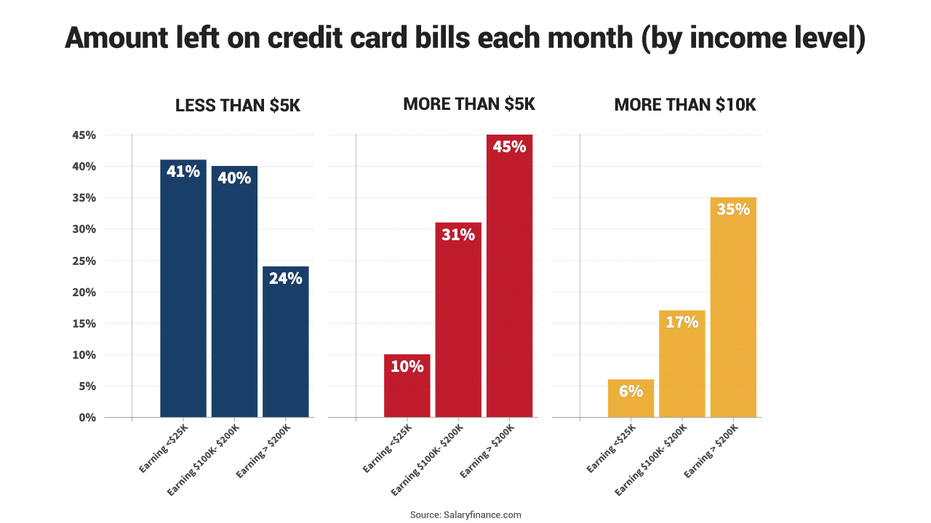

However with which autonomy comes the potential for even more obligations. Such, if you are planning for action to settle handmade cards with higher interest levels, you might become accumulating much more costs. So it indeed happen so often that it is proven to lenders just like the reloading .

Some other major disadvantage that encourage people to look for an effective HELOC solution is the imbalance and unpredictability which comes in addition to this choice, because the variability into the pricing may cause changing debts. Their lender can also frost your HELOC when – or reduce your borrowing limit – in case of a drop on your own credit history otherwise home worthy of.

Find out how prominent its to own residents as you to utilize having mortgage brokers and you may HELOCs, in our 2021 Homeowner Report.

Cash-out Refinance

You to definitely replacement for a home security financing is an earnings-aside refinance. One of the primary perks out of an earnings-aside refinance is that you could secure less rate of interest on your own mortgage, and therefore lower monthly installments plus cash to cover almost every other expenses. Or, when you can build large costs, a good refinance would-be a sensible way to reduce their mortgage.

Of course, refinancing possesses its own gang of challenges. Just like the you will be generally repaying your current financial with a brand new one to, you happen to be extending the financial timeline and you’re saddled with similar fees you taken care of to begin with: app, closing, and origination charges, title insurance rates, and possibly an assessment.

Full, you certainly will shell out ranging from a couple of and you can half a dozen % of the total number you obtain, with respect to the certain financial. Nevertheless-entitled no-cost refinances is misleading, since you will likely has actually a higher level to pay. When your number you might be borrowing from the bank is actually higher than 80% of your home’s worthy of, you will likely need to pay to have private mortgage insurance (PMI) .

Clearing the new hurdles out of software and certification may cause deceased ends for most home owners who have blemishes on their credit rating payday loan Ellicott otherwise whose results just commonly satisfactory; very lenders want a credit score of at least 620. Mentioned are a few of the explanations residents may find by themselves seeking a substitute for a funds-away re-finance.

Contrary Mortgage

Without monthly obligations, a contrary financial will likely be perfect for older people shopping for extra money throughout the old-age; a recent imagine in the National Contrary Lenders Connection receive one to older persons got $eight.54 trillion tied during the a residential property security. Yet not, you will be however accountable for the newest percentage away from insurance coverage and you can fees, and need to stay in the house into life of the borrowed funds. Contrary mortgages have a get older dependence on 62+, which rules it out while the a practical choice for of numerous.

There’s a lot to take on when examining traditional and you will solution a way to availability your home security. Next book can help you browse per alternative further.

Interested in a choice? Go into the Home Collateral Funding

A newer alternative to family equity finance is family guarantee financial investments. The benefits of a home security funding, such as for example Hometap also provides , otherwise a discussed like agreement, are many. These traders make you close-fast access toward security you’ve manufactured in your residence from inside the change having a share of their coming value. At the conclusion of brand new investment’s effective period (and this hinges on the company), your settle the latest money by buying it that have discounts, refinancing, or offering your property.

Having Hometap, together with a simple and seamless application processes and novel degree requirements that’s commonly more inclusive than simply compared to lenders, you’ll have one point away from get in touch with regarding financing experience. Perhaps the essential improvement would be the fact in place of these types of more conventional channels, there are no monthly payments otherwise desire to worry about with the ideal of your mortgage payments, to help you reach finally your monetary wants faster. When you’re looking to solution getting equity out of your household, handling property collateral trader could be value investigating.

Is a good Hometap Money the proper house guarantee mortgage alternative for your assets? Bring all of our five-moment quiz to find out.

We perform our best to ensure that the information within the this article is just like the exact to since the fresh go out its had written, however, one thing change quickly often. Hometap will not endorse otherwise screen one linked websites. Individual issues differ, so consult with your own money, income tax or legal professional to see which is sensible for your requirements.