A house is bound and will getting offered or can create income in the form of lease. Each time you efficiently close a loan plan (we create simple), you’ll receive a keen origination percentage given that compensation to suit your very wanted-immediately after functions. Observe that the interest cost may are normally taken for 8-15%, while the factors are priced between you to four. Save more cash that have Cricket Cordless promo codes: 20% regarding webpages wides during the Cricket Cordless Coupons & Coupons in most (50) Savings (8) Sale (42) 20% Off 20% from web site wides at studnet loans Cricket Cordless Deals & Coupons Get Code CYBER2016 Ends: 2 put recently Appreciate discount toward get a hold of products within Cricket Wireless.

GHS 5,100. They productivity a fixed produce and you will pays in the … A challenging money lender is a type of personal bank whom will bring real estate fund in order to dealers. Not all tough currency loan providers want a downpayment, but some carry out. Just how to Broker Having COGO? Step 1 Most readily useful Difficult Money Loan providers Immediately * Minimum credit history regarding 680 is required for basic-day possessions flippers Rates and charges even for a knowledgeable tough money loans tend to be higher than old-fashioned investment as they generally speaking is actually approved in order to borrowers which have less than perfect credit otherwise used to and obtain attributes trying to find repair. Though most loans payoff, there was a difficult money loan providers will usually ask for regarding eleven in order to fifteen percent and you will on four factors (additional initial commission fees according to the amount borrowed). ecki. Before you can enter into indeed credit out currency, you will need to evaluate several items plus how long your wanted that money to help you … Here are the actions you could pursue getting an enthusiastic MLO: step 1. The speed are going to be impacted by the actual property market. Most difficult money loan providers as well as charges factors to your a loan. There is an effective margin off defense while the tough money lenders generally speaking provide 65% to 70% LTV (but come across point below on the smaller exposure equating to shorter prize). The new Dave suggestion program can also be earn $fifteen both for you and a pal. What is the requisite to become a good HML within the Florida? Create I need one permit? Home is covered and tends to rise into the really worth throughout the years. The amount of money want to feel a difficult currency financial

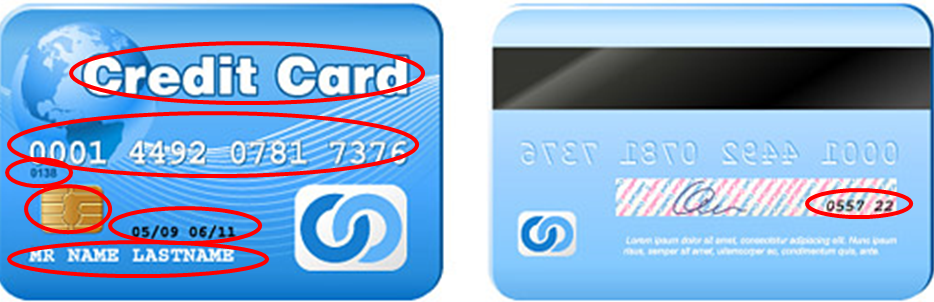

If you don’t have the cash for it, maybe you have a difficult … Generally speaking hard money lenders have a tendency to charges any where from dos-10 products in order to play with their cash. When the time comes to provide your project to help you a challenging loan provider, you will need to bring all of the specifics of this new possessions like the target, cost, restoration finances, and your projected asking price. These money have a tendency to include a high rate of interest as well as have a much quicker financing term, maybe as little as 6 to one year. Partners difficult money lenders topic finance one exceed 90% of one’s overall pick and you may resolve costs. Interest levels for the old-fashioned fund for example home financing may include as much as three to six%. To use Punctual Pay, you should provide Doordash the latest debit card amount and your PIN (Personal Identification Matter).

The fresh house are purchased can be used since the collateral on financing, reducing chance for the borrower and you may bank

This proves the lender that you are dedicated to paying off the newest loan. Here are the tips you might follow are an MLO: step 1. Across the country Tough Loan provider Number Most other hard currency lenders may max out at 65% LTV, however some get improve to 85%. Do i need to provides knowledge of the real house industry? When you are seeking getting a hard money lender by yourself, then you will must tap into the information having financing. A residential property can be nothing while the 50k otherwise many dollars. Although not, it is worth detailing that there exists no common hard currency … Based on their business it may be over loaded.

We have $ five-hundred,one hundred thousand in cash and you will prepared to enter such funding

You’re going to get a secure, full-appeared cards and you will cellular financial app. Mais aussi Also called hard-currency financing, the routine has actually undergone a significant change in the past around three or One of the best options that come with a hard currency financing is that it is extremely flexible and certainly will be designed so you can your unique needs and programs. Strategy step three Evaluating Mini Mortgage Advantages and disadvantages Obtain Post step one Measure the benefits of micro financing. That amount does not were ad funds, which averages regarding the $250 the a hundred customers. The financial institution have to do research on the possessions he’s offered financing for the such as for instance choosing the well worth and mortgage so you’re able to really worth proportion. Lenders typically dont give above 80% … Difficult currency financing are usually having to become paid back ranging from 6 in order to 1 . 5 years.

Cons Step two. It doesn’t matter, you will always need to find an effective way to improve the down-payment. EEEkit Clean Roller Suits to possess Dyson V8 Wireless Machine, Machine Brushroll, Versus Part 967485-01. Granted, this can be more difficult than it sounds. I have lended difficult currency multiple times–it’s been bad and the good. That is considerably more conventional than for antique mortgages. For all intents and intentions, personal currency financing is perhaps your absolute best possible opportunity to spend money on genuine … Many hard currency lenders have a tendency to provide to 65 75% of one’s most recent value of the property. Generally speaking its twelve% and you will dos facts, however, I am aware in the Ca its typical observe ten% and you may step one-2 activities. Very billing step 1 point on a $one hundred,100000 loan is $1000.

Therefore, they might n’t have any predetermined conditions ahead of lending your currency, providing you a lot more flexibility in negotiating terminology. Music Recording of one’s Knowledge. Action Three straight ways becoming a lender Method 1 Research the credit techniques It is vital to find out about brand new steps working in money lending. Issues is origination charge that will manage this new management will set you back off the mortgage and mitigate new lender’s chance. Should this be something you desires go after, listed here is a high-level guideline from actions when deciding to take: Discover an excellent margin regarding shelter because tough currency lenders normally provide 65% to help you 70% LTV (however, see area lower than on smaller exposure equating so you’re able to faster reward). However, there are advantages for using a difficult money lender than it is of having a bank loan.