Every single business has to expand and you can an enthusiastic infusion of cash support the firm progress for the a positive way. Loans are a great way to finance the growth and you will the relevant costs. not, there are certain essential circumstances that one must look into before applying getting particularly funds.

Obtaining a corporate financing is not fundamentally an intricate procedure, however,, best arrangements ensure that your risk of success. Pursuing the certain procedures and you will choosing a lender one to centers on SMEs helps make your company funding simple. Discover a number of loan providers exactly who offer SMEs having small and easy access to best loan for their team. Examine today if you qualify for punctual money-

This will be the first matter you will deal with, thus ready your effect ahead of time. It is vital to to learn about their you need and you may eventual utilisation of your mortgage. Loans are used for several aim – it can be the acquisition out of index, equipment, offers otherwise chairs and for working capital. The explanation behind the loan often determine the nature of loans readily available additionally the banking institutions that are ready to support you.

It is important to think about new lending options offered to Indian SMEs and determine your best option to suit your needs. You can try federal and you may regional finance companies, credit unions, and low-earnings small-loan providers. These firms give team credit lines, business fund, and even personal loans.

Additional options in addition to signature loans, crowd-financial support, and organization credit cards can an intelligent alternative while the the application form is effortless, and the agreement is generally punctual and you may dilemmas-100 % free.

As the brand of financing you require the most is decided, the next thing is to work out should your eligibility for a corporate mortgage. Most finance companies, along with those providing loans, depend on the non-public borrowing from the bank of your own business owner(s) when making behavior.

Your goal was one thing in making an application for good organization loan. You should have obvious suggestion about whether your objective are so you’re able to dispersed so you can the new areas or bring a better unit/provider to the niche market. Pick would be to delineate their address.

When your needs are set, it is very important split identify them on the particular amounts you to definitely can assist you see your own goals. Should your aim would be to target this new segments, you will need to begin fresh mes as well as hire resources to offer and gives assistance for the targeted market.

Money is the lifeline of any providers. Before applying getting a business financing, you should no upon how much money you prefer given that financing. To take action you must work out Emerald installment loan bad credit no bank account the main city you need secure the factors wanted to meet your company desires.

It usually is advisable to ready yourself a business plan to endeavor the period of time for which you will need the latest second monetary support.

A detailed business strategy ‘s the first average away from selling the vision and you will monetary strength on the financial. An effective business plan sets ahead their business’s facts, from the basis to their experience of industry. It depicts their business’ mission and also the roadmap for finding wants. Monetary reports give a whole studies away from just what you’ve already done as well as your coming preparations.

Loan providers accept that businesses submitting an extensive business plan possess a great ideal possible opportunity to succeed and you will shell out its mortgage right back promptly

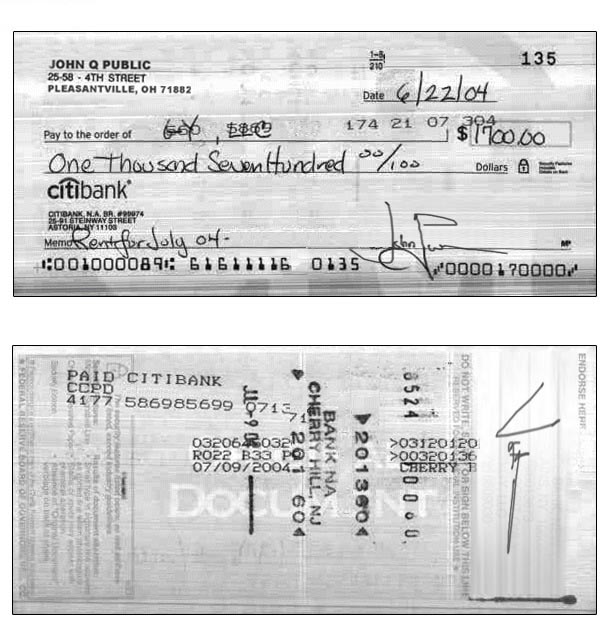

Loans usually want thorough documents. Loans which have financial institutions, borrowing unions, or on the internet loan providers request additional details about oneself and your company. Get ready on data.

Control minutes for business loans confidence the type of mortgage therefore the amount questioned. Even though some need months or weeks to own recognition and money anybody else reply in one day or a couple.

When you find yourself denied, find out the cause for the unapproved financing and replace your chances the next time. Often you can find opportunities offered hence match your company best. Just remember that , each time you get that loan a painful borrowing from the bank query is done, and each inquiry is also miss your credit rating from the several factors.

Apart from the old-fashioned loan providers, there was a keen emergent pattern to the strange lenders to incorporate organization money so you can SMEs

The way to get good at your odds of bagging a business mortgage will be to purchase time in the foundation in advance of submitting a loan application. If you prefer assistance with the credit or cash flow, take called for actions to develop such elements just before approaching finance companies. Once you are sure regarding the condition, see business loans to identify the best lender to you and you can your online business.